Problems

in DeFi

Unstable Returns

The returns and costs from existing money market protocols fluctuate based on supply and demand of individual pool, which is unsuitable for long-term borrowers/lenders.

Inefficient Prices

As proven in TradFi, for fixed-income instruments, combining batch auctions in the primary markets and orderbook in the secondary markets is the most suitable way for price discovery.

Unhedgeable Risks

DeFi users have neither forward products and term futures to hedge exchange risks nor fixed-income markets to hedge interest rate risks.

Mission in 3 Stages

1. Establish a term structure of interest rates as a fundamental infrastructure.

2. Provide full hedging instruments to both DeFi users and TradFi institutions.

3. Enable fixed rates term financing for tokenized Real-World Asset in DeFi.

2. Provide full hedging instruments to both DeFi users and TradFi institutions.

3. Enable fixed rates term financing for tokenized Real-World Asset in DeFi.

Fixed Income

Protocol

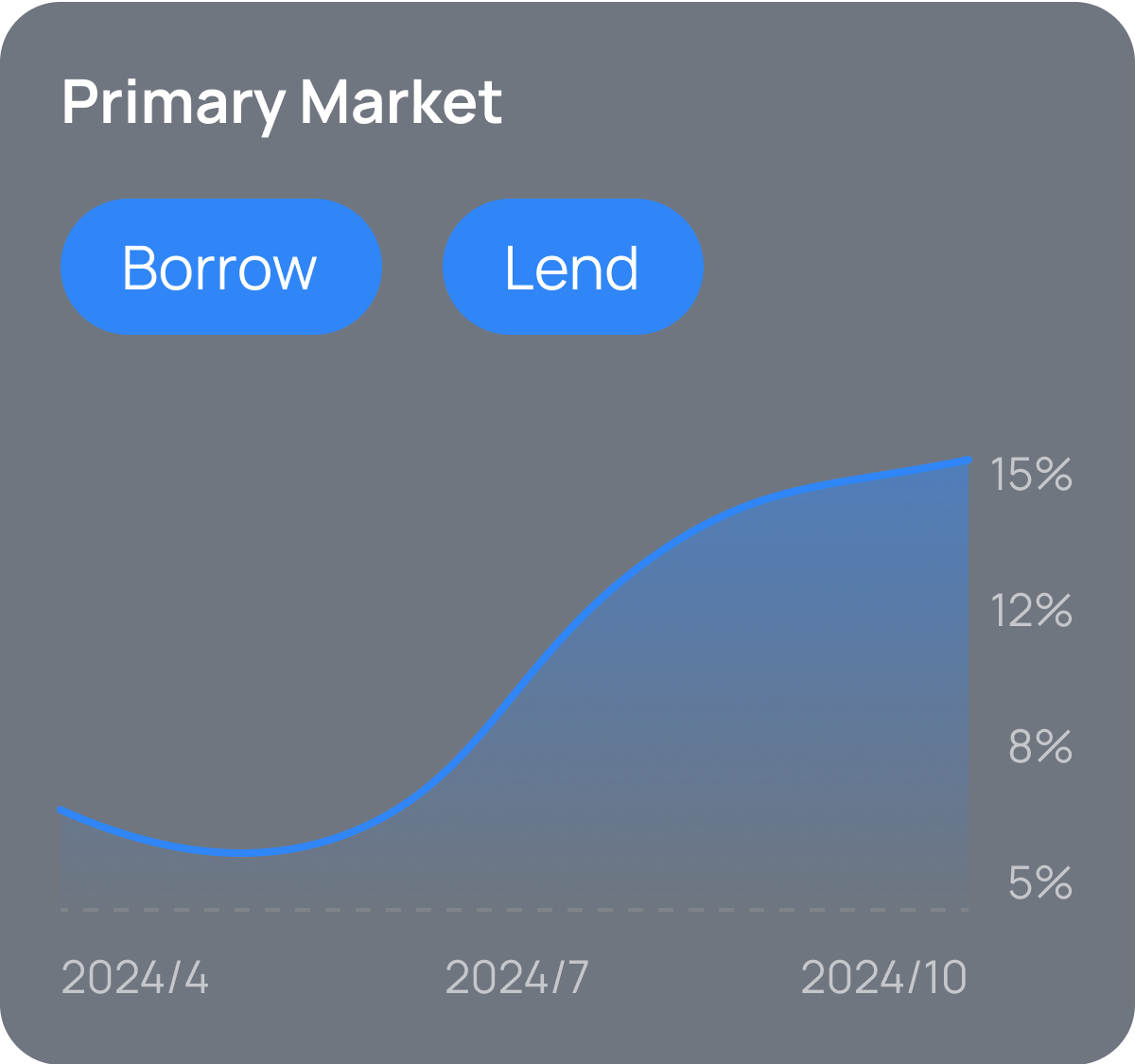

Primary Market

Multiple batch auctions a day to match standardized borrowing / lending orders

- Most tokens with sufficient liquidity will be the underlying tokens and can be used as the collateral, including ETH, WBTC, USDC, USDT and DAI

- 75 ~ 90% LTV (Loan to Value) and liquidation mechanism guarantee lenders' returns

- Available maturity date would be the last Friday of March, June, September, December and that of the following two months

Secondary Market

Orderbook exchange for price discovery of fixed-income tokens

- Users can trade their fixed-income tokens for hedging and risk-taking

- Primary dealers will provide liquidity in secondary markets

- Primary dealers can enjoy fee waiver plus profit sharing after the obligation fulfilled

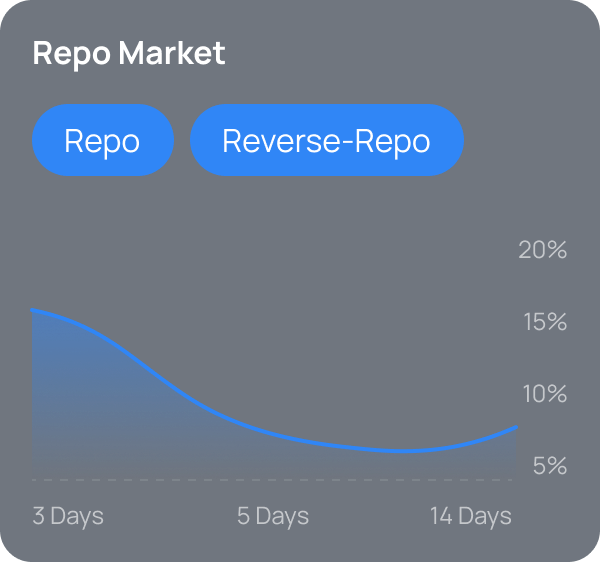

Repo Market

Orderbook exchange for collateralized loans with fixed-income tokens

- Users can collateralize their fixed-income tokens to borrow the underlying tokens

- A foreclosure auction protects borrowers' valuable fixed-income tokens from a fire sale

- Available repo tenors are 3-day, 7-day

zkTrue-up

zkTrue-up is a customized zk-rollup solution for auction and orderbook matching on DeFi. zkTrue-up ensures fairness and privacy for auctions by leveraging Zero-Knowledge Proof and Sparse Merkle Tree technology. Overall, zkTrue-up guarantees data availability and security, and makes orderbook matching efficient and scalable.

What Makes us

Different

Non-custodial

Thanks to zkTrue-up, a custom-built ZK-rollup based on zk-SNARKs, users always control their assets and execute forced-withdrawal to secure assets without concerning protocol risk.

Peer-to-peer

Compared to other fixed-income protocols, Term Structure adopts a peer-to-peer model rather than peer-to-pool, enabling users to use limit orders and have better quotes.

User-friendly

Interdependent primary, secondary, and repurchase bond markets allow users to take risks and hedge with flexibility. Transparent cost and zero slippage provide a better trading experience.

Roadmap

Investors